Have you heard of the landlord who rented out his apartment, and the tenant skipped the second payment?

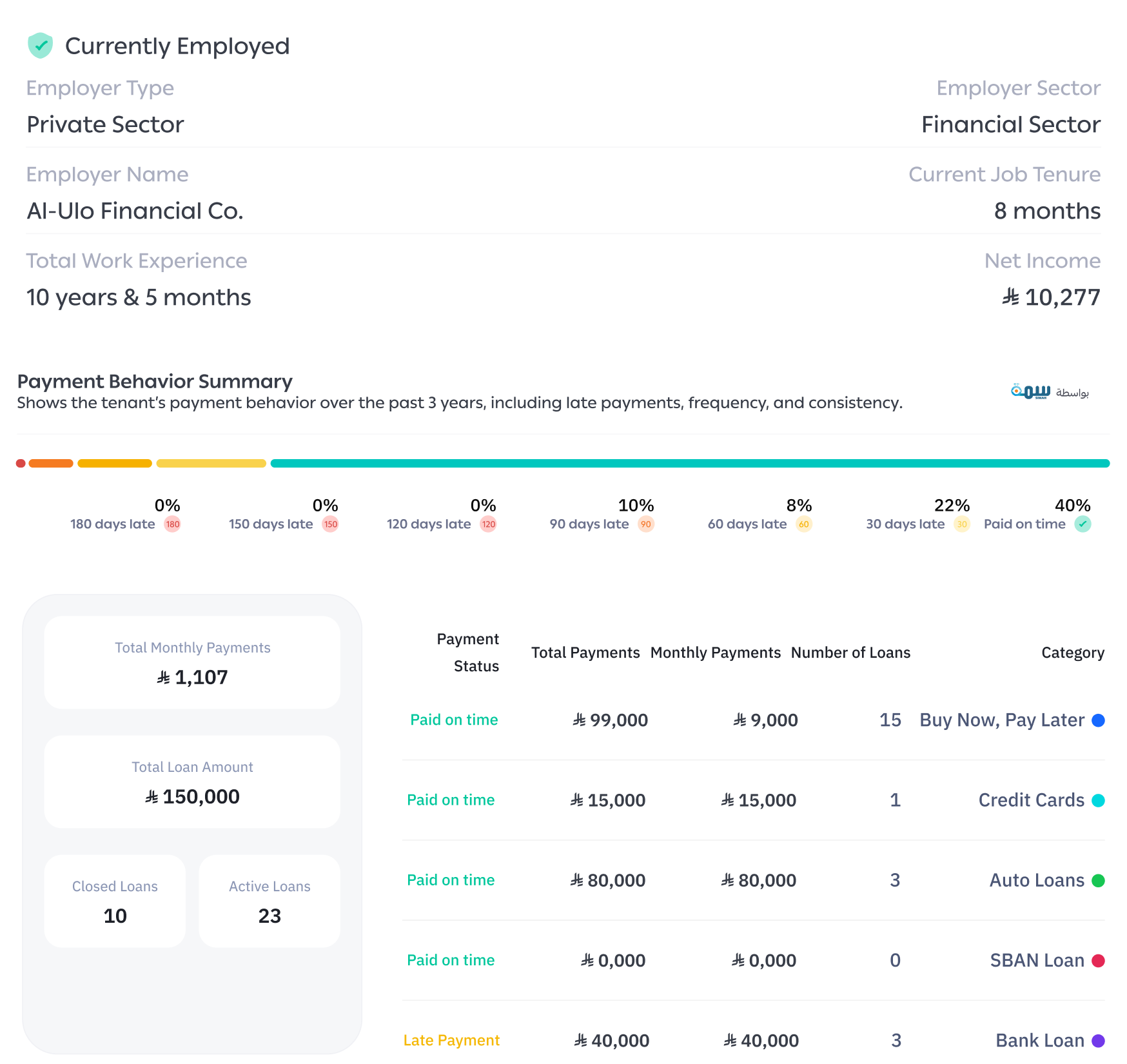

Don’t fall into the same situation… With Shayek from Rize, you can uncover financial claims and defaults before signing. A simple report protects you from surprises.